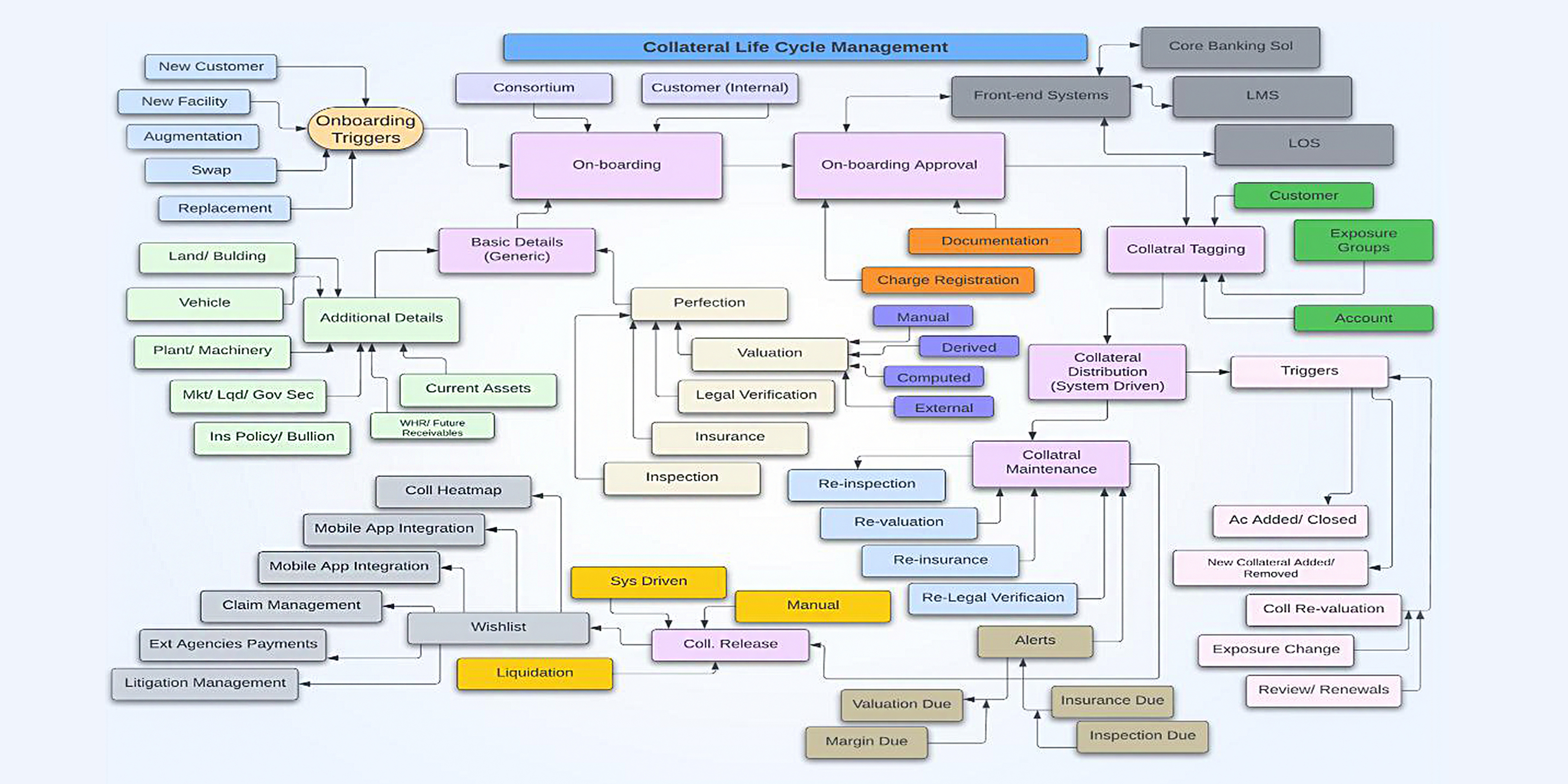

The Enterprise Collateral Lifecycle Management System (ECLMS) offers a powerful suite of features designed to transform how financial institutions manage collateral, delivering significant strategic advantages across risk mitigation, regulatory compliance, operational efficiency, and overall business performance.

E

C

L

M

S

E

C

L

M

S