E

C

L

M

S

E

C

L

M

S

E

C

L

M

S

E

C

L

M

S

Collateral onboarding is a time-consuming, multi-stage workflow involving external parties for perfected charges. Its manual nature leads to long turnaround times, hindering throughput and scalability. Automating maintenance is crucial for ensuring collateral remains in good standing, protecting lender interests and facilitating smooth recoveries.

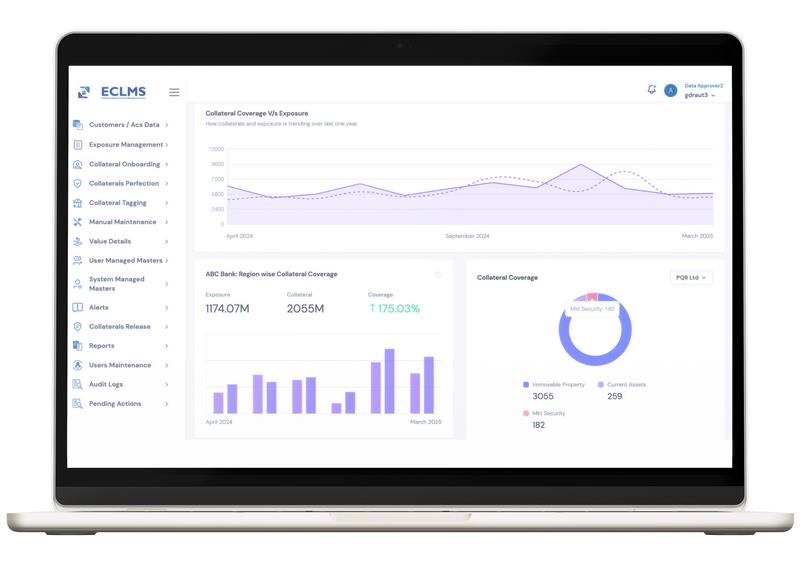

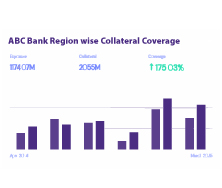

ECLMS is an enterprise-level system that monitors regulatory and internal exposure limits for various groupings (Group, Customer, Industry, Sector, etc.). It proactively alerts relevant stakeholders when thresholds are breached, aiding in the proper maintenance of charged collaterals. Through near real-time, two-way integration with source systems, ECLMS ensures a synchronized and up-to-date enterprise-wide view of lender collaterals, simplifying operations while ensuring regulatory compliance.

ECLMS (Enterprise Collateral & Limit Management System) is an end-to-end solution designed to automate the entire lifecycle of collateral management. It helps banks and financial institutions streamline processes, improve operational efficiency, mitigate credit and operational risk, and ensure regulatory compliance. ECLMS also provides real-time updates, seamless integration with existing loan systems, and automation of key tasks like collateral valuation and maintenance, reducing manual intervention and errors.

Yes, ECLMS is designed to manage complex collateral structures, including multi-bank and consortium arrangements. It supports various ownership structures and handles multiple charges (First Charge, Pari-passu, etc.) with real-time collateral distribution among lenders. The system also dynamically tracks and updates collateral value for shared securities across different exposures.

Absolutely. ECLMS ensures regulatory compliance by automating processes, maintaining a historical record of collateral data, and providing audit trails for all transactions. It minimizes manual intervention, ensuring that all regulatory guidelines are met, and helps institutions avoid compliance risks.

ECLMS prioritizes data security with advanced encryption protocols, strict user access controls, and detailed audit trails. The system ensures data integrity, preventing unauthorized access or tampering, and guarantees that your institution’s sensitive information is protected at all times.

You can easily request a demo or get more details by filling out the Contact Form on our website. Our team of experts will get in touch with you to schedule a personalized demonstration and answer any specific questions you may have.